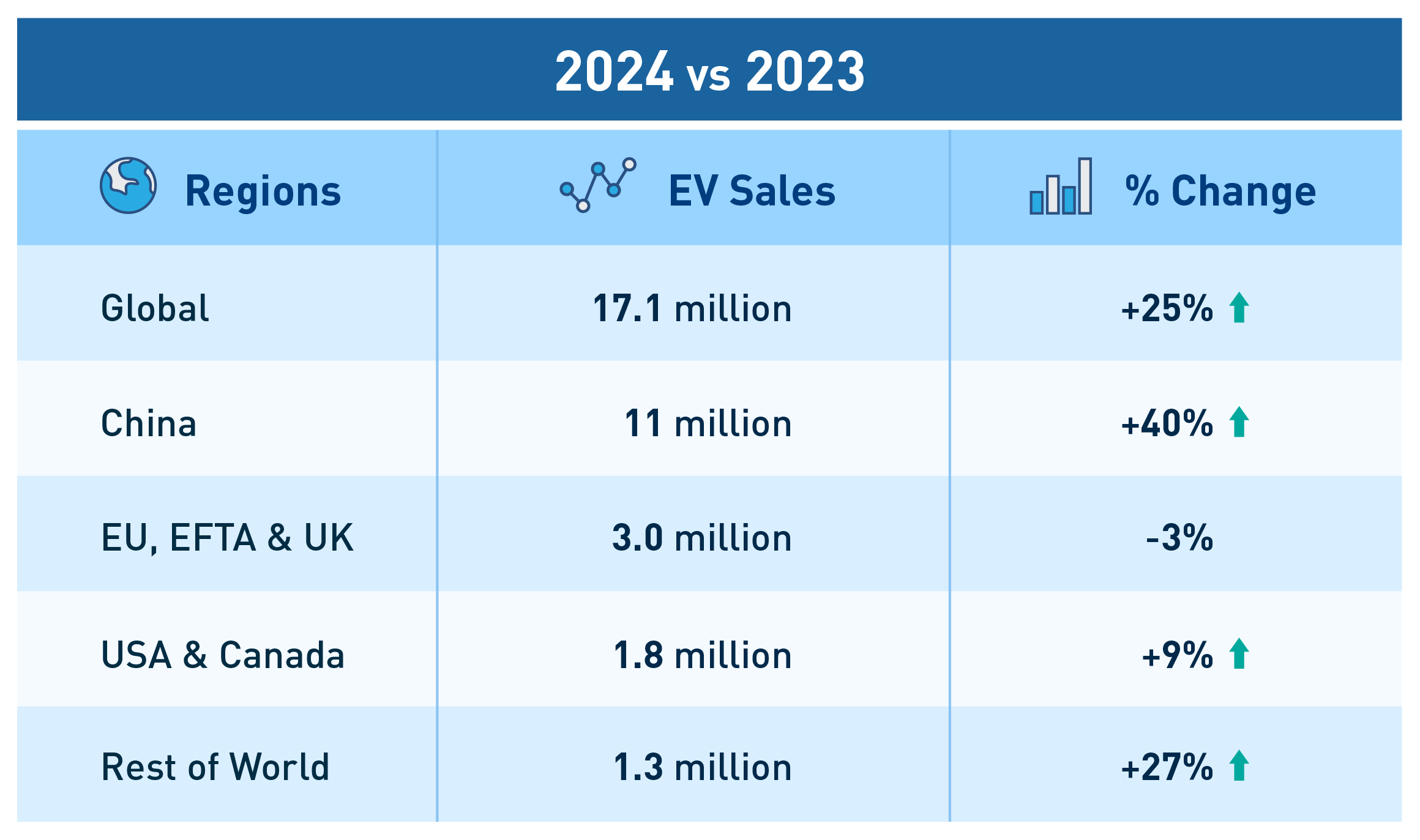

Global EV Sales Increase by 25% in 2024

In 2024, global electric vehicle (EV) sales surged 25%, reaching 17.1 million units, as reported by EV market research firm Rho Motion. This record-breaking total highlights the remarkable growth of the EV market and its increasing significance in the automotive industry.

The numbers reflect extraordinary growth and a complex interplay of market dynamics, regional variations, and sustainable mobility efforts. These factors demonstrate the shifting priorities of governments, manufacturers, and consumers toward a cleaner and more sustainable future.

This article explores the factors driving progress, regional highlights, and what the future holds for the global EV industry.

Source: Rho Motion | Global EV sales reached 17.1 million units, a 25% surge in 2024 compared to 2023.

Why 2024 Marked a Milestone Year for Global EVs

According to the International Energy Agency (IEA), EVs accounted for 21% of global car sales in 2024, meaning one in five cars sold worldwide were electric. This remarkable growth was fueled by several key drivers:

Government Policies: The Backbone of Global EV Growth

Government policies and incentives played a pivotal role in accelerating EV adoption across various regions. Key initiatives included:

- United States:

Federal agencies disbursed over USD 2 billion in tax credits to EV buyers, significantly lowering upfront costs and encouraging adoption. - China:

The government implemented trade-in subsidies, incentivizing owners to replace outdated petrol-powered vehicles with new energy vehicles, including EVs. - United Kingdom:

The Zero-Emission Vehicle (ZEV) mandate introduced stringent production requirements for automakers, ensuring a steady increase in zero-emission cars and vans produced annually until 2030. - France:

The malus tax on high CO2-emitting or excessively heavy vehicles became stricter, encouraging consumers to opt for low-emission alternatives. - Netherlands:

EV owners were exempted from motor vehicle and motorcycle taxes, further reducing the cost of ownership. - Italy:

Government incentives and significant ownership tax exemptions made EVs an attractive choice for Italian consumers. - Spain:

EV buyers benefited from personal income tax breaks, encouraging broader EV adoption. - Belgium:

Certain regions provided complete exemptions from registration taxes for battery electric vehicle (BEV) and fuel cell electric vehicle (FCEV) owners.

These diverse policies fostered EV adoption through financial benefits for buyers and regulatory frameworks promoting market growth.

Consumers Embrace Sustainability

Changing consumer preferences toward sustainability also contributed significantly to the surge in EV sales. Environmental sustainability, including reducing carbon footprints and waste while protecting habitats, has become a key concern for many buyers.

Younger generations, in particular, are driving demand for sustainable products. International efforts like the United Nations’ Sustainable Development Goals (SDGs), promoting awareness in over 170 countries, have boosted this trend. With sustainability increasingly viewed as a necessity rather than a luxury, consumer interest in EVs continues to grow.

Expanding Choices for Global EV Buyers

The range of EV brands expanded in 2024, with over 150 brands competing globally. This growth includes well-established automakers transitioning to electric and new entrants focusing exclusively on EV innovation. Regional breakdowns include:

- North America:

Approximately 35 brands, including Tesla, Rivian, Ford, Lucid Motors, Electra Meccanica, and Lion Electric. - Europe:

Around 40 brands, led by established names like BMW, Volkswagen, and Renault. Sweden’s Polestar also gained significant traction. - Asia:

Asia is the largest EV market, with over 60 brands including NIO, BYD, Xpeng, Nissan, Toyota, and Hyundai making substantial investments in new models.

This expansion of brands has provided consumers with more choices than ever before, fueling broader EV adoption.

China: The EV Leader

China led the global EV sales in 2024, selling 11 million units—a 40% increase from 2023. This remarkable growth highlights the strength of China’s EV ecosystem and its ability to dominate the global market.

-

PHEV Growth

China’s EV growth was driven by an 81% year-over-year surge in plug-in hybrid electric vehicle (PHEV) sales. PHEVs gained popularity due to range-extender electric vehicles (REEVs), which combine electric propulsion with an internal combustion engine. This technology, less adopted in Western markets, addressed range anxiety and boosted the appeal of hybrids, gaining significant traction in China.

-

Government Incentives

China’s success in the EV market was further bolstered by robust government support. China’s Ministry of Commerce, Finance, and other departments introduced new subsidies to boost the car market in 2024.

Among these measures, the “Implementation Rules for Car Trade-in-Subsidy” offered subsidies of up to 10,000 yuan for trading older vehicles for EVs. This initiative encouraged buying new EVs and retiring less environmentally friendly vehicles, supporting the transition to cleaner transportation.

-

What It Means for 2025

With policies extended into 2025, China is set to retain its dominant role in the global EV market. China’s focus on PHEVs and subsidies provides a blueprint for other regions aiming to grow their EV markets. This approach highlights the importance of addressing diverse consumer needs while maintaining a consistent commitment to policy-driven growth.

China’s EV market leadership shows how strategic support and consumer-focused solutions drive adoption, setting a benchmark for other nations.

Europe: Mixed Results in EV Sales

In 2024, the European electric vehicle (EV) market faced mixed outcomes. While the combined markets of the European Union (EU), the European Free Trade Association (EFTA), and the United Kingdom (UK) experienced an overall 3% decline in EV sales, certain regions demonstrated notable growth, highlighting the diverse challenges and opportunities across the continent.

-

UK’s Resilience

The UK became a standout in Europe’s EV market, surpassing Germany in total EV sales and achieving 20% year-over-year growth. This growth was driven by the UK’s Zero-Emission Vehicle (ZEV) mandate, promoting zero-emission vehicle production and sales.

The ZEV mandate requires automakers to ensure a percentage of annual production consists of zero-emission cars and vans. By 2030, 80% of new cars and 70% of vans sold must be zero emissions, transitioning fully by 2035. The policy supports automakers’ shift to electric vehicles while boosting consumer confidence in sustainable mobility options.

-

Challenges in Germany

Germany, traditionally one of Europe’s strongest EV markets, faced significant setbacks in 2024. The abrupt removal of government subsidies for EV purchases at the end of 2023 had a pronounced negative impact on sales. This policy shift underscored the critical role of government incentives in maintaining market stability and growth.

The German market’s struggles highlight the sensitivity of EV adoption rates to changes in policy. Without consistent support mechanisms, consumer demand can wane, slowing the transition to sustainable transportation and placing additional pressure on automakers to offset declining sales.

-

What It Means for 2025

To address the challenges and revive growth across Europe, targeted measures will be essential. Governments may need to reintroduce or enhance subsidies tailored to consumer needs, incentivizing the purchase of EVs. Additionally, the expansion of EV infrastructure, particularly the deployment of public charging stations, will play a crucial role in fostering broader adoption.

By creating a balanced approach that combines financial incentives, robust infrastructure, and supportive regulatory policies, European markets can work toward reversing the decline and solidifying their position in the global EV landscape.

The varied performance across Europe underscores the importance of supportive policies and infrastructure investments in accelerating the momentum of EV adoption.

North America: Steady Growth in EV Market

The U.S. and Canada ended 2024 on a strong note, achieving a 9% growth in electric vehicle (EV) sales. Together, the two countries sold a total of 1.8 million units, reflecting steady progress in the transition to cleaner mobility solutions.

-

U.S. Government Incentives

Federal incentives played a significant role in boosting EV sales across the U.S. since January 2024. Consumers saved over USD 2 billion in upfront costs on 300,000 electric and plug-in hybrid vehicle purchases. These savings were facilitated through federal tax credits, making EVs more affordable and accessible to a broader audience.

Additionally, the U.S. government introduced a mechanism allowing tax credits of up to USD 7,000 to be directly transferred to registered dealers. Over 250,000 advanced payments linked to tax credits for new clean vehicles highlight the mechanism’s significant market impact. This initiative streamlined the purchasing process, reducing financial barriers for consumers.

-

Electric Vehicle Investments

Significant investments in EV-related infrastructure and manufacturing facilities further strengthened North America’s EV ecosystem in 2024. The U.S. Department of Energy funded EV supply chain facilities, including production sites for electric vehicles and batteries.

These investments not only supported domestic manufacturing but also created a robust foundation to mitigate potential disruptions from regulatory uncertainties. By focusing on infrastructure development and supply chain resilience, the region is better positioned to sustain its EV growth trajectory.

-

What It Means for 2025

To maintain momentum in 2025, North America must preserve supportive policies and accelerate EV infrastructure development. Key actions include expanding public charging stations, offering subsidies, and ensuring stable policies to boost consumer and industry confidence.

However, potential risks loom, particularly in the form of policy reversals. Changes to Environmental Protection Agency (EPA) emissions standards, for example, could create uncertainty and hinder progress. Addressing these risks will require proactive measures and a long-term commitment to advancing the EV industry.

North America’s progress in adopting EVs underscores the importance of consumer-focused policies and investments to ensure sustainable development in the years ahead.

Source: IEA | 1 in 5 Cars Sold Globally Were Electric in 2024.

What the Numbers Don’t Tell You

While the 2024 statistics highlight significant progress in the EV industry, they also expose critical challenges that must be addressed to ensure sustained growth and long-term success.

-

Supply Chain Vulnerabilities

The increasing global demand for electric vehicles is placing significant pressure on the supply of essential raw materials. Key components such as cobalt, nickel, graphite, platinum, copper, manganese, phosphorus, iron, and lithium are indispensable for manufacturing EV batteries and other components.

However, the availability of these resources is highly concentrated, with only a few countries capable of supplying them. The primary suppliers include China, Russia, the Philippines, New Caledonia, Congo, Zimbabwe, South Africa, Australia, Turkey, Canada, Cuba, Bolivia, Chile, Brazil, and Argentina.

This geographic concentration presents potential risks for the global electric vehicle supply chain, including price volatility, geopolitical tensions, and limited access to resources, all of which could disrupt production and delay delivery timelines.

-

Infrastructure Gaps

The rapid growth in EV adoption has outpaced the development of charging infrastructure, creating a significant disparity between the number of electric vehicles on the road and the availability of charging stations. Automakers, governments, and private enterprises are collaborating to address this issue by deploying ultra-fast chargers designed to drastically reduce charging times, thus enhancing the convenience of EV ownership.

In Europe, for example, the European Automobile Manufacturers’ Association (ACEA) estimates that 8.8 million public charging stations will be required by 2030 to meet the demand for electric vehicles. However, as of 2023, only approximately 630,000 public charging stations had been installed. This shortfall underscores the urgent need for accelerated infrastructure development to support the expanding EV market.

-

Policy Volatility

Germany’s electric vehicle market decline in 2024 underscores the risks of abrupt policy shifts. The removal of government subsidies at the end of 2023 led to a significant slowdown in EV adoption, demonstrating how quickly market dynamics can shift in response to policy adjustments.

This example certainly highlights the importance of consistent and stable government support for the EV industry. Policies that incentivize adoption, such as subsidies, tax breaks, and investments in infrastructure, must be maintained over the long term to ensure steady growth. Without such stability, consumer and business confidence may falter, potentially undermining progress in the transition to electric mobility.

Challenges in the EV industry emphasize the need for strategic action on supply chains, infrastructure, and policies to sustain and drive EV momentum in the coming years.

Partnering with Industry Leaders for the Future of EVs

As the EV industry continues to grow, the need for innovative manufacturing solutions is more critical than ever.

Lead Intelligent Equipment (LEAD) stands at the forefront of this transformation, offering advanced battery production systems and automation solutions to meet the increasing demand for electric vehicles. With a proven track record of delivering state-of-the-art equipment, Lead Intelligent Equipment empowers businesses to scale their operations efficiently and sustainably.

Whether you are a startup venturing into EV production or an established automaker seeking to enhance your manufacturing capabilities, partnering with LEAD ensures you are prepared for the challenges and opportunities ahead.

Contact us to learn more about how our expertise can drive your success in the evolving EV landscape.

Explore More: Top Global EV Market Trends for 2025 and Beyond

Discover what’s next for EVs! Dive into our next article, Top Global EV Market Trends for 2025 and Beyond, where we explore the key drivers shaping the future of the EV industry.

Sources

- https://rhomotion.com/news/over-17-million-evs-sold-in-2024-record-year/

- https://www.iea.org/reports/global-ev-outlook-2024/executive-summary

- https://www.gov.uk/government/news/pathway-for-zero-emission-vehicle-transition-by-2035-becomes-law

- https://electrek.co/2025/01/14/ev-growth-rose-again-in-2024-despite-media-political-lies-saying-otherwise/

- https://www.undp.org/sustainable-development-goals

- https://www.goldmansachs.com/insights/articles/electric-vehicle-battery-prices-are-expected-to-fall-almost-50-percent-by-2025

- https://www.iea.org/reports/global-ev-outlook-2024/outlook-for-electric-vehicle-charging-infrastructure

- https://de.ecarstrade.com/blog/tax-benefits-and-incentives-for-electric-vehicles-in-eu

- https://de.ecarstrade.com/blog/increase-of-automotive-taxes-in-france

- https://www.acea.auto/press-release/electric-cars-eu-needs-8-times-more-charging-points-per-year-by-2030-to-meet-co2-targets/

- https://home.treasury.gov/news/press-releases/jy2626

- https://www.automotivedive.com/news/2b-ev-tax-credits-car-buyers-dealers-2024-ira/728850/

- https://carnewschina.com/2024/05/01/new-trade-in-scheme-set-to-boost-chinese-car-market/

- https://techdriveplay.com/2024/06/06/how-many-electric-car-brands-are-there-in-2024/

- https://www.now-gmbh.de/wp-content/uploads/2020/10/EN_Factsheet_RohstoffeEmob_2020.pdf

- https://www.cleanenergywire.org/news/abrupt-end-german-electric-car-subsidies-fuels-doubts-about-green-mobility-target